does colorado have inheritance tax

Only a handful of states have such inheritance tax laws and Colorado is not among them. Federal legislative changes reduced the state death tax credit between 2002 and 2004 and ultimately.

State Estate And Inheritance Taxes Itep

Form 706 or 706NA for a nonresident alien decedent is required to be filed.

. While the estate tax is a federal tax an inheritance tax will only apply if your state has one in place. Some states such as delaware oregon washington and connecticut also have state estate taxes. A state inheritance tax was enacted in colorado in 1927.

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. There is no inheritance tax in Colorado. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax.

Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. Only a handful of states have such inheritance tax laws and Colorado is not among them.

Inheritance tax is a tax paid by a beneficiary after receiving inheritance. Up to 25 cash back Does Colorado have a state inheritance tax. The good news is that Colorado does not have an inheritance tax.

Does Colorado Have an Inheritance Tax or Estate Tax. Types of Estate Administration. Until 2005 a tax credit was allowed for federal estate.

Devisees or heirs may collect assets by using an affidavit and do not have to open a probate action through the court. My children are worried they are going to pay an outrageous amount of taxes when I die. What documents or supporting evidence do you have.

Form 706 or 706NA for a nonresident alien decedent is required to be filed. No Colorado does not have an inheritance tax. Inheritance tax and inheritance tax rates are often misunderstood.

Colorado Inheritance Law FAQ Contents Executor Trustee. In some states this person is called the personal representative. Restaurants In Matthews Nc That Deliver.

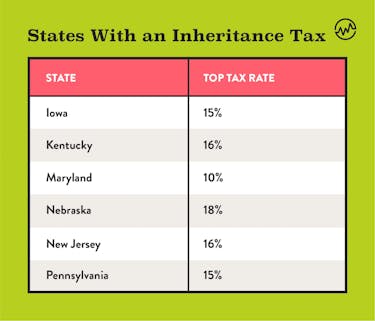

Colorado does not have inheritance taxes but there are federal estate taxes. In fact only six states have state-level inheritance tax. Thats especially true for.

Inheritance taxes are different. Colorado doesnt have an inheritance or estate tax anymore. It does not matter where the heir lives.

Tax is tied to the federal state death tax credit to the extent that the available federal state death tax credit exceeds the state inheritance tax. A state inheritance tax was enacted in colorado in 1927. That tax is levied after the money has.

Small estates under 50000 and no real property. If theres a probate court proceeding the court officially appoint. Colorado does not have an inheritance tax or estate tax.

However if you are receiving an inheritance from someone who. Opry Mills Breakfast Restaurants. In some states a person who receives an inheritance might have to pay a tax based on the amount he or she has received.

The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there and the heir is in a class that isnt exempt from paying the tax. The Colorado estate tax is the. Income Tax Rate Indonesia.

Essex Ct Pizza Restaurants. In Kentucky for instance inheritance tax must be paid on any property in the state even if the heir lives elsewhere. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional.

Inheritance Laws in Colorado. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance.

Colorado estate tax replaced the inheritance tax for decedents who died on or after Jan. The state where you live is irrelevant. Does Colorado Have An Estate Or Inheritance Tax.

This means if the proposal passes an individual with an estate valued at over 3500000 will have to pay 45 on the excess of the limit up to. There is no estate or inheritance tax in Colorado. The state of Colorado for example does not levy its own inheritance tax.

Informal process generally allowed when there is a. Estate tax is a tax on assets typically valued at the. Anything else you want the lawyer to know.

Colorado does not have inheritance taxes but there are federal estate taxes. The recoupling does not affect the. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million.

Colorado also has no gift tax. Inheritance tax is a state tax only. If it does its up to that person to pay those taxes not the inheritors.

9117 amended December 23 2003. Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicated. A state inheritance tax was enacted in colorado in 1927.

Tax Return DR 1210 must be filed if a United States Estate and Generation-Skipping Transfer Tax Return federal. No documents just wanting to let them know what Colorado does. Colorado Inheritance Tax and Gift Tax.

But that there are still complicated tax matters you must handle once an individual passes away. Some states might charge an inheritance tax if the decedent dies in the state even if the heir lives elsewhere. An inheritance tax may be due if you inherit money or property from a deceased person who lives in a state having an inheritance tax or if the heir inherits property that is physically located in such a state.

Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. An important note here however is that if the individual youre receiving inheritance from resides in a state with inheritance tax then it can apply regardless of the state you live in. There may be capital gains taxes on the inherited property if you sell.

An heirs inheritance will be subject to a state inheritance tax only if two conditions are met. There is no estate or inheritance tax in colorado. A state inheritance tax was enacted in Colorado in 1927.

Luckily the basic exemption for federal taxes is high so that most estates wont have to pay an estate tax. An executor is the person either appointed by the court or nominated in someones Will to take care of the deceased persons financial affairs. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

The good news is that colorado does not have an inheritance tax. Unlike estate taxes the heirs are liable when there is an inheritance tax. Delivery Spanish Fork Restaurants.

Soldier For Life Fort Campbell.

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How To Avoid Estate Taxes With A Trust

Recent Changes To Estate Tax Law What S New For 2019

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Colorado Estate Tax Do I Need To Worry Brestel Bucar

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Is There A Federal Inheritance Tax Legalzoom Com

Eight Things You Need To Know About The Death Tax Before You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit